NPS scheme benefits in 2023, What is NPS Scheme, Purpose of NPS, Types of NPS Accounts, What are the benefits of NPS,Old pension scheme

As all of us work whether as an employee or business to earn enough money to take care of daily expenses of our family .The goal of working for money also to take care of our future and after retirement life.

You must have different opinions in investing your savings for which financial planning plays an important role. Among the retirement planning investments PPF and NPS are two most popular methods to cover your retired life financially.

In this article I will try to cover the details of NPS

What is NPS Scheme

Let us understand the historical background of National Pension Scheme.

NPS is a government-initiated pension scheme and it is among the popular long-term preferred investment plans for retirement.

NPS started with the resolution of the Government of India to discontinue defined benefit pensions for all its employees who joined after 1 April 2004.

The NPS scheme was originally intended for government employees only; it was released for all citizens of India between the age of 18 and 65 in 2009.

It allows account holder to add regularly to a pension account while they are working. The person can prefer a sum as per his or her requirement .

If you are an NPS account holder, you can extract an amount of the corpus and will keep on getting the remaining amount through a monthly pension after retirement.

In an NPS account, account holder’s contribution is invested into various debt and equity instruments .The returns on NPS depend on the performance of the investments and on market conditions.

Purpose of NPS

NPS was introduced with the object of providing retirement income to all citizens. It is open to all Indian citizens between 18 and 60 years of age.

- This scheme is applicable for every person working in the Public Service, private sector, or any other .Everyone receives retirement benefits as and when applicable.

- The scheme is intended to encourage the habit of saving among citizens to continue their financial stability even after post-retirement.

- Other benefits of NPS are: Capital protection, security of benefits, growth with equity, accountability and transparency.

Types of NPS Accounts

Tier I – Minimum opening amount ₹250, does not allow withdrawals till retirement .Linked with employer.

Tier II – Minimum opening amount ₹500. No limits

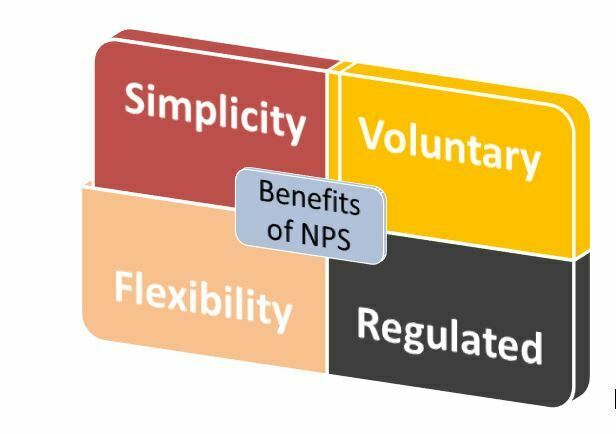

What are the benefits of NPS?

Voluntary: It allows the account holders to add their preferred amount at any time of the year and can also alter his/her payment every year.

Simplicity: Subscribing to NPS is as simple as a Subscriber is required to open an account with any one of the POPs (Point of Presence) or through eNPS

Flexibility: Individuals can choose their investment mode and fund as per their requirements and see their money grow.

Regulated: Since it is under the regulations of PFRDA, NPS has transparent investment norms and regular monitoring and performance review of fund managers by NPS Trust.

Returns/interest: A portion of the total scheme deposit is invested in equities to generate higher returns than other conventional tax-saving instruments like PPF. It generally offers 9% – 12% CAGR returns making it appropriate for long-term safe investment.

After retirement withdrawal rules: After retirement, individuals can withdraw a maximum of 60% of their total contribution, which is also tax-free. The remaining 40% is returned to the investor as a regular pension from the PFRDA registered insurance firm.

Equity allocation: One of the NPS benefits allows investors to decide the distribution of their contributions as per their choices and requirement.

Investors can choose active choice or auto choice. The active choice allows subscriber to opt funds, while the auto choice considers the age and risk profile of an investor before investing.

However, as per the equity allocation rule, investors can allocate a maximum of 75 % of the corpus on equity

Comparison of NPS scheme with PPF: Which is Better

Amongst a number of investment tools in India, the National Pension Scheme and the Public provided Fund are the most common options followed by most Indians.

But it is still confusing to choose the right one in terms of returns, interest rates etc as investors often get confused between these two plans.

So I am just trying to find out the comparison and merits and demerits of both investment instruments. We will try to understand both the products in detail.

So let us start our analysis:

Difference between NPS and PPF

Background basis

NPS is a market based pension savings scheme of Government of India to offer financial support to retired persons. The returns on NPS are dependent on the stock market conditions and pension fund performance.

PPF is also a government-based instrument that has fixed returns.

On the basis of investments

In NPS, the minimum age eligibility for deposit is 18 years and the maximum age for investment is 65 years.

In PPF investments, there are no age restrictions.

Minimum and maximum investment amounts for PPF investors are ₹500 per year and ₹.1.5 lakhs per year.

The minimum investment amount for an NPS investor is ₹1000 per year and for salaried persons, there is no maximum limit.

On the other hand self-employed can invest a maximum of 20% of their gross total annual income.

Safety

As NPS returns are depending on market conditions, it is usually not considered a secure option. The ups and downs of a market will have an effect on your return amount in this scheme.

On the other hand, in PPF, you can be sure about any risk of defaulting as it comes with fixed returns.

Therefore, investors looking for details on NPS vs PPF returns can refer to the below table.

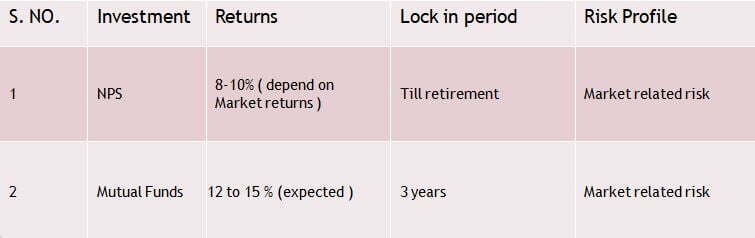

Comparison of NPS scheme with Mutual Funds

Limitations of NPS

In this world, we all people know that nothing is perfect .Hence NPS scheme has also some demerits and limitations .

1- No Liquidity: NPS is like a ULIP in which investor looses all liquidity till his /her retirement. Suppose you want to withdraw your invested amount few years before 60, then you will allowed to find only 20 % amount as tax free and 80% of your corpus to annuity.

2- Lesser flexible due to compulsory annuity: The investor in NPS is compulsorily to put 40% of the corpus in a low-yield option and these low annuity rates won’t beat inflation.

3- Cap on equity portion also restricts growth potential: Younger investors want to invest more in equity portion to get higher returns in long terms .But the equity portion being 75% maximum restricts growth potential.

4- Less transparency: Changing AMC or asset allocation is not as easy .However Govt is planning to ease the process.

New Updates in NPS scheme account

As we can see that there are frequent changes and updates come in news and government keep on updating the same.

Old Pension scheme Updates

As per latest update on old pension scheme , the central govt employees can switch from NPS to old pension scheme in certain specific conditions like in the event of death or disablement .

As per latest memorandum issued by deptt of pension and pensioner welfare ,the government employees can switch the scheme as per Central Civil Service Rules ,2021 (Rule 10) .

You cannot make contributions to NPS Tier II accounts using your credit card

The Pension Fund Regulatory and Development Authority (PFRDA) is under final talk to stop accepting credit card payments for subscriptions and deposit in the National Pension System (NPS) Tier-II accounts.

The regulatory body PFRDA has instructed all Points of Presence (PoPs) for stopping acceptance of credit cards for deposit to NPS Tier II accounts right away.

Scheme preference change in NPS

For the convenience and flexibility for the NPS subscribers, NPS authority has relaxed the rules . As per new rule ,the subscriber can change the scheme preference in NPS four times in a financial year. Earlier this limit of change in scheme preference was two times in a financial year.

However it is not advisable to frequently change the schemes as it may break the compounding effect in long term .

According to the regulator, it has been decided to disallow credit card use in NPS Tier-II accounts as a part of its authority under Section 14 of the Pension Fund Regulatory and Development Authority Act 2013 (PFRDA Act)

to protect the interests of subscribers and to control, promote, and ensure orderly growth of the national Pension System and pension schemes to which the Act applies.

Guaranteed pension programme under the NPS scheme

The (NPS) account subscribers may get a guaranteed pension scheme by the end of September 2022.

The Pension Fund Regulatory and Development Authority (PFRDA) is considering over a guaranteed pension programme under the NPS scheme.

The regulator PFRDA may commence this assured pension scheme under NPS from 30th September 2022.

Supratim Bandyopadhyay, Chairperson at PFRDA informed PTI about the PFRDA plans in regard to guaranteed pension programme under the NPS scheme

Conclusion

By having the ins and outs of the NPS scheme, we can have the important takeaways . You should invest in NPS for your portion allotted for retirement fund. The retirement fund may be divided in two parts. One part may be deposited in NPS and another part in safer PPF.

As NPS has advantage of equity exposure in addition to fixed returns which helps the retirement corpus to grow relatively faster in the long run-up to retirement. Also, the fund deposited in NPS is managed by professional fund managers under strict regulation of PFRDA.

NPS can also be for tax benefit. You can make use of yearly 50,000 as an additional income tax rebate u/s 80CC thus total limits get increased to two Lacs while for the normal tax-saving space available of ₹1.5 lacs only .

In this way additional ₹50,000 is exclusively available for NPS. Hence, NPS may be considered as advisable options for investors to build a retirement corpus.