REITs in India, How to invest in REITs in India, Advantages of REITs, Precautions before investing in REITs

As a retail investor ,you may start investing in the stock market by a small amount, even INR 500 only. The amount can be flexible as per your financial planning and you may choose the SIP route for investing regularly as per your saving capacity.

But when you as an investor want to diversify your portfolio and want to purchase any real estate property ,you have to arrange minimum amount in lacs to purchase a small land or flat or any commercial building .

In this way, the purchase of any piece of land ,office or real estate is not an easy task for a small investor due to high ticket investment size. .

To resolve the practical problem of retail investors and to make the real estate investing flexible , the first REIT was launched in India in 2019.

In REITs ,investor can have flexible investing as per their SIP planning.

To make you understand the full details of REITs investing ,I have invested in REITs and as per my personal experience I am presenting this article.

Please go through till end to get the maximum value out of it. I hope it will be helpful to you .

What are REITs

REITs ( Real Estate Investment Trusts) works as per the concept of mutual fund house .

As MF manager collects the money from different investors and invests in the stock market as per the expertise of the field ,in the same way REIT takes the money from all the interested investors and they buy the real estate properties in prime places for recurring income generation.

REITs target to earn rental income from the purchased properties as well as the capital appreciation of the property.

REITs usually invest in commercial properties like shopping malls ,stores, warehouses or offices where they can generate regular rental income.

They focus on office properties and they distribute the rental income of the office properties to their investors in the form of dividend.

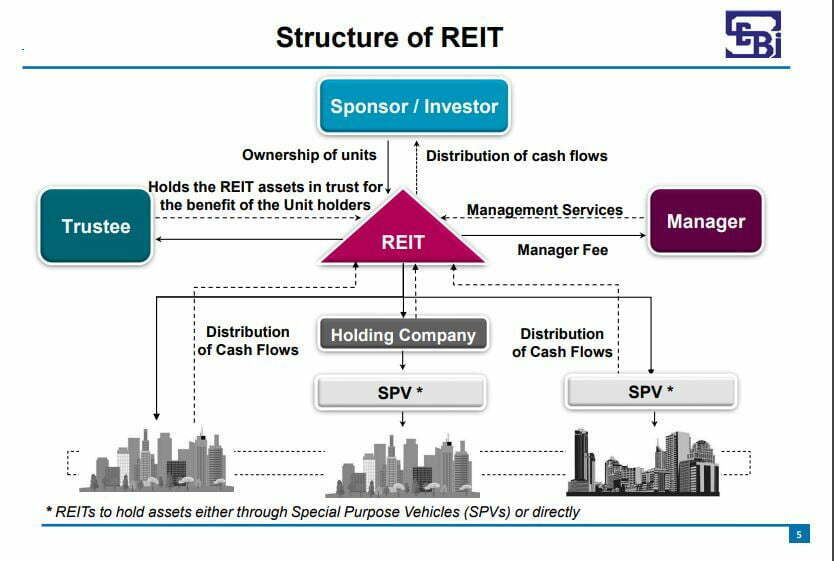

As per SEBI ,the structure of REIT can be mapped between sponsor/investor ,Trustees and Manager .This explains the roles of all factors in REIT investing .

How to invest in REITs in India

REITs are traded on the stock exchange just like stocks of the listed companies .You may purchase these REIT units at the stock exchange for which you need a demat and trading account with any reputed brokerage house like Zerodha ,ICICI securities , SBI securities or any other AMC .

As the minimum investment is not very high hence small investors can also start purchasing small quantities as per their financial planning .

Before 30th July’ 2021, the criteria of minimum investment amount was NR 50,000. But after this date ,SEBI notified and revised the minimum investment amount as INR 10,000 to INR 15000 as per lot size.

Listed REITs in India

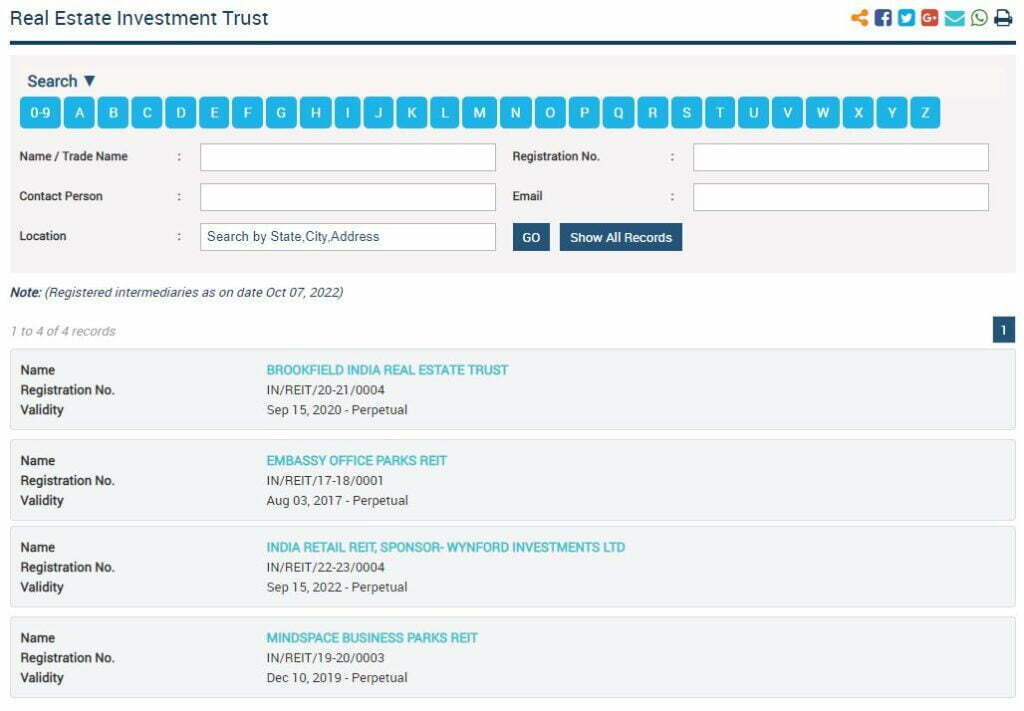

As per SEBI website as on date ,India has four REITs available for investing .

The Embassy REIT

Embassy REIT is owned by Embassy and Blackstone group who are pioneer in real estate industry .

This REIT is Asia’s first and one of the biggest REIT. The firm has ownership of many office parks, hotels and a 100 MW solar power facility.

Mindspace REIT

This REIT is sponsored by K Raheja Corp Group .It has a diverse portfolio of office premises at different cities like Hyderabad , Mumbai, Pune and Chennai.

Brookfield India REIT

This REIT is sponsored by famous investing firm Brookfield AMC. They have offices located in Mumbai, Gurugram, Noida, and Kolkata.

Types of REITs in India

As per the basis of investment ,the business operations and the underlying policy, REITs can be divided in different categories.

Equity REITs

In this REIT type the properties like office buildings or malls are fully owned by the trust . They generates regular income through rental properties . This type of REITs is most popular and they distribute the rental income through dividends to the investors .

Mortgage REITs

Mortgage REITs are the type of REITs which lend money to other businesses who are dealing in real estate industry. Their primary source of earning money is through mortgage payments or EMI . These REITs also deal in mortgage-based properties and receive interest income .This interest income is shared with investors.

Hybrid REITs

Hybrid REITs are mixture of both equity REITs and Mortgage REITs .The income for these REITs is both from rent and interest.

Other types of REITs are

Public but not listed

Private REITs

Publicly traded REITs

Benefits /advantages of Investing in REITs

The aim of introducing REITs was multi fold however the main benefits of investing in REITs may be listed

Long term returns

REITs are considered long term assets and the returns are decent in investing in REITs for long duration .

Liquidity

The main drawback of real estate investing is high illiquidity . But by introduction of REITs units which are feely traded on stock exchange ,this problem of liquidity has been resolved . The flexibility of buy and sell in REITs has made them a good investment tool.

Transparency

SEBI has ensured that these trusts follow strong governance and disclosures are done as per SEBI requirement.

Diversification

As equity ,bonds or gold investments are already popular investments ,REITs are used as diversification of investments to balance portfolio .

Stable and regular dividend

Through REITs ,you may earn stable and regular income in terms of dividend . This may be the good source of passive income for investors.

Precautions while investing in REITs

As stability of income of any REIT is fully dependent on income generated by the properties invested. Hence investors should do the detailed research before taking investment decision.

As a intelligent investors ,you should invest in REIT which follow better transparency in terms of regular disclosures . Lot of regulations like SEBI(REITs) Regulations ,2014 ,SEBI( Listing Obligations and disclosure requirements) regulations ,2015 and many more resgualations have been imposed by SEBI to protect the interests of retails investors.

Like wise RBI regulation Foreign Exchange Management (Non-debt instruments Rules ),2019 is also applicable

You should understand the business model of the particular REIT and keep the track on the results and investments like earning material, earning calls , annual meeting and valuations of REITs.

The regular monitoring and tracking is required for REITs also as in case of stocks rather doing buy and hold strategy to avoid losses.