What are mutual funds, Mutual fund investing for beginners, Checkpoints for beginner investors ,How mutual fund investing works, How to select Mutual funds, Comparison of MF Vs PPF

What are mutual funds?

A mutual fund is an investment scheme in which investors like you & me invest their money in stocks, bonds and other assets through indirect method.

In this method we do not directly invest in market by our own rather we give our money to any Mutual fund company or Asset Management Company for investing on behalf of us.

In MF investing, there are fund managers who gather our capital and invest this money on our behalf. The regulatory body for mutual funds sector in India is Association of Mutual Funds in India.

These fund managers are vastly experienced in investing field and educated .They have proficiency in investing money in proper asset class.

Mutual fund investing for beginners

Investing in mutual funds looks complicated for the beginner investor like us. You may get confused with the jargons of mutual funds like CAGR, exit load or fee for investment etc .But to begin with, the first step is to understand how the mutual funds work.

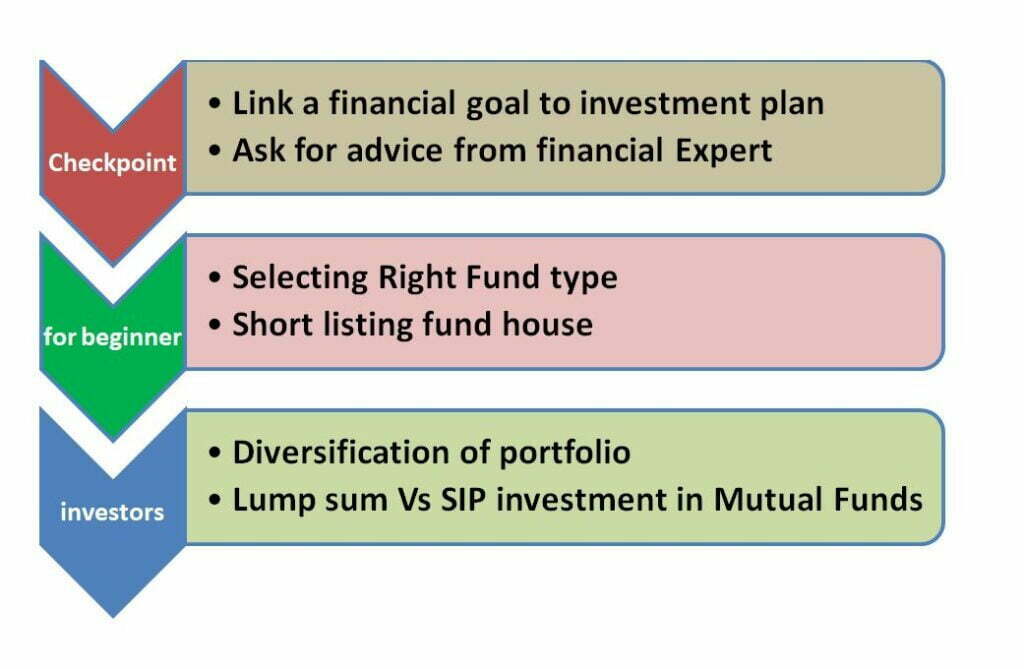

Checkpoints for beginner investors

The beginner investors should take care the following points before investing in MF

Link a financial goal to investment plan

If you are a beginner, you should clearly arrive at your budget ,your saving plan, your regular income and time horizon as these all play a significant role in your investment journey .This planning will definitely make you decide the amount of investment and plan of action as per your risk profile. The investment journey always becomes fruitful when it has purpose like children education, purchasing the house or marriage of children etc. Due to this purpose, the motivation to invest with discipline also comes deeply.

Ask for advice from financial Expert

The process of investing in Mutual fund is technical which needs expertise in handling the investments. With hundreds of mutual funds, you as an investor have to select from them on their merits and demerits. The performance of MF is also to be monitored regularly .For which you may seek the services of a mutual fund expert and distributor.

Selecting Right Fund type

There are different types of mutual funds like balanced funds or equity funds or debt funds. The right category is to be selected as per risk profile and financial goals. The types of MF are as below:

1- EQUITY MUTUAL FUND– In Equity mutual funds, your money is invested by fund manager in share market . This MF is meant for the investors who are ready to take risk and their risk appetite is high.

2- DEBT MUTUAL FUND- In Debt Mutual Funds ,the mutual fund manager mainly invests in debt or fixed income securities like Treasury Bills, Corporate Bonds ,Government Securities and other debt securities .These mutual funds are less risky than the equity mutual funds but ROI is also low or fixed.

3- HYBRID MUTUAL FUND- This is the mixture of EQUITY MF & DEBT MF. They are highly spread funds which enable these funds less risky but at the same time the ROI is also low in these funds.

There are other types also as per the underlying assets .

Choosing fund house

Investors should find out the performance of fund house and also analyze factors like the fund manager’s testimonials, expense ratio, portfolio components and AUM.

Diversification of portfolio

You should diversify your portfolio in different categories and different fund houses to cover the risk and earn decent returns in long term. It will be beneficial as if one fund underperforms ,other fund may cover the performance and balances the overall returns .

Lump sum Vs SIP investment in Mutual Funds

It is always better to invest in systematic investment plans (SIP) mode in Mutual funds instead of lump sum one time investment as you never know about risk of market volatility.

You may end up investing at peak of market cycle which may affect your returns drastically. SIP route allows you to spread the investments over long time and averaging the investment as you will be investing at all levels of market cycle.

How mutual fund investing works

A mutual fund is created when an asset management company collects savings from different persons and institutional investors with common investment aims.

In Mutual fund the fund manager efficiently handles the pooled investment by using the expert tools of investing in different assets to make highest returns for the investors.

The mutual fund houses charge an expense ratio, which is considered the annual fee to manage the mutual fund. This fee is deducted from the returns of mutual fund.

You as investors will make money from regular capital appreciation of NAV.

You may select the choice reinvesting the capital gains through a growth option or receive a fixed income by way of a dividend alternative.

How to select Mutual funds

As you as a retail investors are not expert in finalizing your financial goals and asset allocation .

As already informed and as per my experience in investing, what I suggest that you should hire a mutual fund advisor or financial planner.

Without financial advisor or expert you will end up choosing MF schemes randomly without thinking about your financial goals, investment perspective and risk profile.

For example, you stated that you made your financial plan and you considered that your risk profile is aggressive but inadvertently you made your profile other way round. You made the portfolio conservative in which your plan is not reflected.

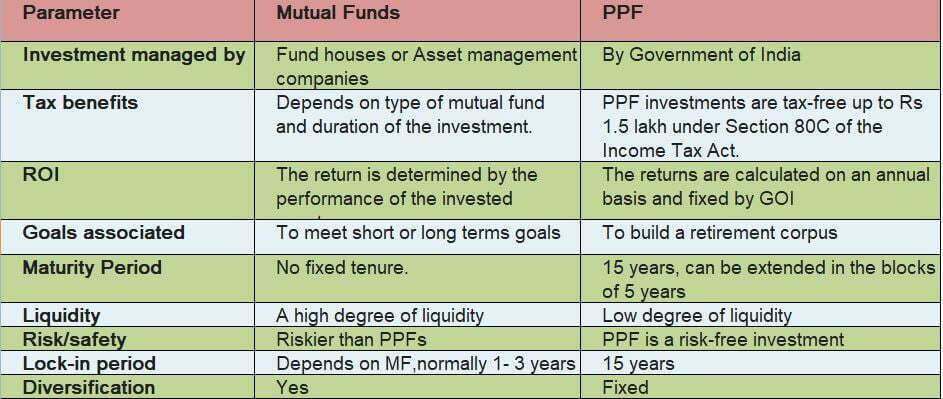

Comparison of MF Vs PPF

Both MF and PPF have their advantage and disadvantages .You should choose the one tool as per your risk profile and financial goal.

Comparison of MF and PPF as per following table :

Mutual fund investment Direct Vs Regular

There are basically in two ways of Mutual fund investing . The first method is DIRECT METHOD or PLAN & the second method is REGULAR METHOD or PLAN.

DIRECT PLAN

ADVANTAGE:

In this method ,you need not to pay any commission that means that all the returns comes to you directly into your pocket . In this method you directly purchase the units from MF website

DISADVANTAGE:

The disadvantage of the method is that you as an investor need some knowledge about the fund house or the scheme in which you are investing. If you do direct investing in MF without knowledge ,it may be risky for your hard earned capital .

REGULAR PLAN

ADVANTAGE

In a Regular Plan, you as an investor invests through an mediator for example a financial advisor, a MF distributor, a renowned broker or any banker. In this method ,you will invest after knowing your risk appetite and financial investment return goals. So if you don’t have knowledge about mutual funds ,you should adopt regular plan for investing .

DISADVANTAGE:

In regular plan ,advisor, distributor, broker or banker charges some money from you for their services . Due to this ,your return on the investment decreases .