Common problems of retail investors| asset allocation| Concentration or diversification of portfolio| Time the market and behaviour control

Current market scenario

Common problems of retail investors is the neglected issue which is not addressed properly due to lack of knowledge and training .Retail investors frequently lose their hard earned money and time due to improper and un learning in investing .

I also struggled a lot in investing before understanding the investing mindset and behaviour . I understand the pain retail investors of losing money in stock market in absence of a tested system .

Though investing is a wide subjetc and life long learning ,still I will try to address the issue with some examples from my own investing journey .So you may keep on reading till end to get the maximum benefits from my small knowledge .

In the world of information, we all keep on listening the conversations around us about how to become millionaire or wealthy and achieve the financial freedom. Passive income and FIRE movement have become the talk of the town within young investors.

New millennial investors have started investing in market and trying to grow on the path of investing through continuous learning . This has positive impact of retail investors on stock market .

These latest changes in behaviour of people are the indications of changing world which will be inclined to capital market investing .This trend will definitely leave behind traditional methods of investing like real estate ,gold or Fixed Income in future .

Who are retail investors in India

As I am trying to list down some challenging problems of retail investors ,you should first understand the details and characteristics of retail investors .

As per investment experts , the non-professional person who wants to earn the gain from the stock market by investing own money can be categorised as retail investor.

How much retail investors can invest in share market

As per SEBI definition, the retail investor is an individual who can fill the application for maximum Rs.2 Lacs in an IPO application for equity issue however there is no maximum limit to invest in stock market .

Recently SEBI has increased the investment limit for payments through UPI mechanism for retail investors to buy debt securities in IPO to Rs. 5 lakh from Rs. 2 lakh . This will bring ease of investment for retail investors.

How retail investor is different from institutional investors ,the following characteristics can provide you a clear picture:

- Retail investors generally trade or invest occasionally with very small capital while big players like Mutual fund houses and institutional investors take the bet on large capital.

- Normally retail investors do not have in depth knowledge of equity markets hence they lack a proper system of investing.

- Retail investors try to maximise their profit in short term and try to time the market for those returns .Some times without much knowledge ,they lose their hard earned money in stock market.

Retail investors statistics

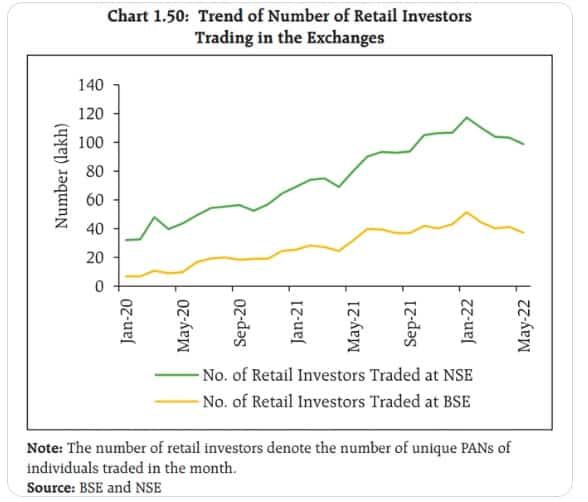

Recent report for retail investors at NSE and BSE shows that the number of retails investors have decreased slightly due to current bear market scenario .However the retail investors are quickly learning about the secrets of investing in bear market.

Despite the above data of declining investors number is for the temporary phase, the interest of retail investors in capital market will keep on increasing in long term resulting rise of community of retail investors.

Currently around 6 crore unique demat accounts are existing in India which is only 4% of the country’s population. The opportunity for growth in capital markets is huge . This is the reason the companies like CDSL ,NSDL or CAMS are having bright future of growth . Active users in trading or investing were only 50 lacs in 2020 as per the reports which have become more than 1 crore by latest data.

Once markets will go up again for bull run this will result in the numbers rise exponentially.

Investors keep on asking

Despite lot of ready material available online for trading and investing ,these new retail investors get confused and keep on asking the questions like :

How to outperform in the market?

Is this the bottom of market?

Is it right time to buy the stocks?

Is it right time to sell the stocks?

Should I change the stocks in my portfolio or increase or reduce?

Should I buy small cap or large cap

These are real common problems of retail Investors which keep on coming every time .

Why retail investors lose money

Despite better and fast information available around the market ,why small retail investors lose money

- Lack of Investment plan aligned with goals

- How to plan asset allocation

- Concentration or diversification of portfolio

- Less money for saving

- Trying to Time the market and behaviour control

- Problems in investment decision

As the above list is not exhaustive and there are hundreds of problems being faced by retail investor community . But to give an idea about some problems in brief ,we have details of each problem for your help and to clear the mind for investing journey

Lack of Investment plan aligned with goals

The new retail investors are still struggling to plan their finances and their life goals .Retail investors know that they want to increase their wealth or become financially free, but they are still to plan the life goals linked to their saving or investing plan.

There is one adage

“If you don’t know where you are going, you will probably end up somewhere else.”

which holds true in investing and financial planning also .Every investment plan and portfolio design should be configured with one’s life objective in mind. The plan should be backed up with one’s risk strategy .

Many investors are attracted by latest investment craze or are focused on maximizing short term investment return instead of designing a robust investment portfolio .

The long term portfolio linked with financial plan always gives steady and consistent returns in future which the new investors neglect .

How to plan asset allocation

Asset allocation simply means that one should plan his or her portfolio by the mix of stocks, bonds, real estate, gold and other assets to have a balance portfolio.

Asset allocation may be the main game changer in portfolio returns, but the asset allocation is not easy to pick and this comes by experience of years to understand the asset allocation strategy .

Some investors follow definite percentage in different assets and some give equal-weight allocation to all assets. Every investor finds that the best performing strategy vary from person to person .

A common observation has been seen by researchers that equity allocation in long term outperforms other asset classes.

By seeing this, one can give argument that if the returns in stocks are highest then why one investor should not put all his money in stocks and achieve highest returns.

But to put all the money in equity portfolio can experience major instability and poor performance at any time as no one can time the market.

It can be concluded that however stock returns in long-term are higher than all other asset classes, investor should put his /her hard earned money in other classes also to give the portfolio stability as no investor can time the market.

One example of asset allocation:

| Equity | 45% |

| Fixed Income /Debt | 20% |

| Real Estate | 25% |

| Gold | 5 % |

| Cash | 5% |

This example can be used by different retail investors like you according to your risk profile .So it is very important to assess the risk profile by any investor before investing .

General Thumb rule given by financial experts is that the equity portion (major portion of investment) should be .

% of equity investment = 100- Age of the individual

i.e suppose your age is 35 years than (100-35 = 65) approximately 65 % of your total saving should go in equity investment for long term. However this is not the hard and fast rule and person can change or plan the asset allocation accordingly . The same should to be reviewed periodically and kept on changing as per age and risk profile.

Concentration or diversification of portfolio

“The idea of excessive diversification is madness” Charlie Munger

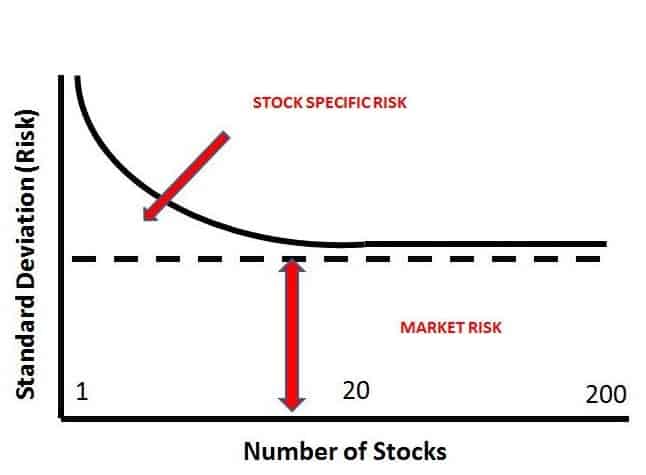

The debate on concentration or diversification of portfolio is never ending as some investors get results from diversified portfolio and some get results from concentrated portfolio.

A diversified, where the portfolio investments are diversified in different asset classes, diversified industries and sectors , diversified geographic regions and countries globally .

The idea behind following diversified portfolio is to spread the risk as one asset can have underperformance for long time or may crash suddenly resulting in huge capital loss.

The proverb that “Don’t put all your eggs in one basket” is the basis of this approach

This type of portfolio generally curtails leveraging as well and keep the portfolio protected.

On the other hand, a concentrated portfolio consists of a few stocks to beat the benchmark. It maximizes likely gain at the cost of very high risk. It works and makes tons of money when the decision becomes right as per the market condition.

But when you fail to spot the alignment of your decision with the market conditions, the losses are great. A concentrated portfolio takes benefit of a large rally or Bull Run but it requires a lot of research and conviction on the idea.

As shown in the given diagram by the experts , at one moment of time the risk does not decrease much despite increasing number of stocks .The optimisation of number of stocks is needed to cover the risk due to concentration in portfolio .

Both the approaches have their pros and cons but an investor gets success only when he plans the risk management in the portfolio and balance of both the approaches.

Less money for saving

The new investors do not have the planning of budget as they have habit of overspending.

They use the formula:

Due to which they are hardly save any money to invest after expenditure. In fact overspending more than means results them in debt trap.

They need to budget well in advance and use the below equation:

The best way to keep on saving and investing is SIP route as this enables the investor to accumulate a lot of wealth in long run.

This disciplined approach results in amount deducted monthly before the same coming in your account for spending.

Trying to Time the market and behaviour control

Investors and experts from long time keep on saying that no one can time the market .

Despite listening this from all the experts, the small retail investor thinks that he can time the market definitely.

He listens all type of news or rumours and keeps on trying to time the market.

To analyse the market cycles, it takes lot of experience and research which is the result of hard work of years.

It is always said that the patience is the key to success in share markets .

Behaviour control

Behaviour control is essentially required as greed and fear are the two extremes of the market and these are to be controlled by training and practicing.

Every investor focuses primarily on how you do things in market, often to the point where he demands perfection in himself in every decision of investment.

In this one should control his/her behaviour and accept the failure and move on in investing life.

Problems in investment decision

The retail investor gathers the knowledge from different sources like news channels, YouTube channels or tips in groups . They act in haphazard way and some wrong advisors take advantage of this behaviour .

The retail investors get trapped in big losses. To solve the problem, one should connect with right financial professional for their financial plan.

Learnings

As per the problems mentioned ,the retail investors are to stick the financial plan and control their decisions by consulting professional financial advisors . The ultimate aim for all the investors is to protect their money from losses and all should remember the philosophy of Warren Buffet.