Buffett once advised once that bear market is “an ideal period for investors.”

How to invest in bear market is the buzzing question everywhere .

Whenever any crazy fall comes in stock market ,retail investors start worrying and want to quit the market .

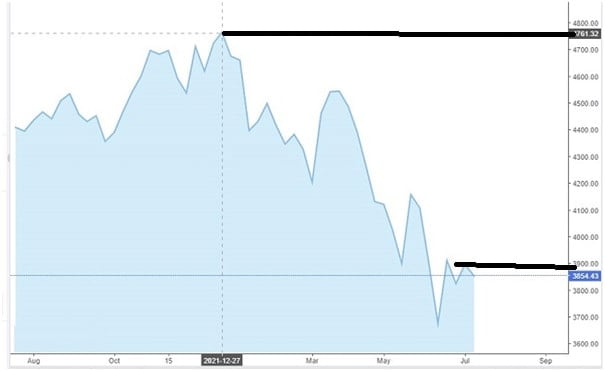

For example ,you may see that S&P 500 fell from its peak of around 4800 in Dec’21 to nearly 3800 level in July,22 (more than 20 5 fall ) as shown below :

New retail investors who entered in stock market after COVID-19 fall saw the trailer of bear market for the first time. As bear market or bull market are inevitable and both are the part and parcel of capital market, you as a retail investor should have clear strategy /system to enter and exit from any stock of your portfolio .

We will discuss some strategies to get benefit of bear market and avoiding losses due to wrong decisions because of fear in capital market.

What is bear market?

The definition of a bear market in stocks is a drawdown of 20% or more from peak to trough .There are terms for correction or recession or crash in markets.

Correction Vs Market Crash Vs Bear Market

1. A correction occurs when the market declines at least 10% from its peak, but not more than 20%.

2. A market crash occurs when the market declines by more than 20% from its peak suddenly due to any external factor .

3. Bear market is a prolonged period of market decline of more than 20%.This continues for uncertain time .

Prominent Signs of bear market

It will be beneficial for all to understand signs of bear market to take the well informed decisions.

The capital markets show the changes to confirm that the bear phase has come.

High interest rates by central banks and high inflation globally which result in high volatility in the stock market.

Traders /investors lose confidence in the financial markets. Even the long term investors become fearful due to major drawdown in their portfolio. Small investors who are unable to handle the volatality and RED in their portfolio leave the market after booking losses.

Stock prices of stock exchanges and brokers keep on falling in anticipation of earning collapse in near furture due to less interst of equity participants.

A decline in IPOs – companies try to avoid issue their public offerings in a bear market to evade depressed company valuations

Traders increase short-selling trades.

Can we predict how long this bear market may last

The bear market has been associated to emotions of market participants. There can be associated with multiple factors which have caused the situations. No one knows the time duration of bear market cycle . It can last for few months to few years also. One can just try to predict that the bear market cycle may end once the factors causing it may disappear.

Market ups and downs

Market does not progress in straight line as it oscillates between extremes of greed and fear. The market becomes over valued due to greed in market and eventually it corrects to reach at fair prices. If this correction prolongs, the market goes in bear cycle and fear dominates the market.

This cycle keeps on repeating itself in the market as shown in sketch below:

Reason behind bear market

The basic reason of bear market is overvaluation .When the PE of stocks and in particular the overall market becomes overvalued the market corrects itself and try to reach its fair price.

Financial discipline and long term investing should not be affected by market dynamics .Markets have seen many ups and downs in long run and the same is to be seen as routine of the market .

Though investing is long term game and an investor is expected to control his emotions of greed and fear. Despite the deep follower of delayed gratification, no investor likes to see his/her portfolio in RED.

That means if someone controls his emotions he can be the winner in capital market.

- As a retail investor one should not worry too much for bear or bull market. Rather you should follow a disciplined system.

- Retail investor should keep on investing SIP route and create a wealthy fortune in 10-15 years without even bothering about ups and downs of market.

- The red colour in portfolio should be considered as the opportunity for long term .

- Investor should invest heavily considering his risk appetite and time horizon of equity investing as financial planning .The financial growth happens with steady investments for long spans.

- Small investor should invest the money which won’t affect one’s day to day life for 4-5 years to avoid the panic situation in bear market.