The Psychology of stock market

The Psychology of stock market players, Mistakes due to Behavioural bias ,The stock cycle due to the Psychology of stock market ,Ways to manage psychology when investing in stocks

The Psychology of stock market is the base of overall performance of the market resulting in market up or down trends . The indicator of the price action in the stock market further decides the direction .

As per great investors like Benjamin Graham, human beings are influenced by emotional and behavioural biases due to which they act as per herd instinct .

Due to these biases ,the players in capital markets start behaving irrationally . This is the major problem of retail investors in stock market .

The FAQs by the investors are :

How can I learn stock market psychology?

How important is psychology in the stock market?

What is mass psychology in the stock market?

What is the best investing psychology? etc

Though these are very vast questions ,still I will try to answer these questions in my article .

The Psychology of stock market players

As the stock market is the combined result of all participants /players associated with it . So to understand the Psychology of the stock market as a whole ,we have to first understand the Psychology of individual players.

How these players react when a situation of either fear or greed comes will decide the market sentiments . This deep understanding of the behaviour of players will make us to analyse The Psychology of stock market easily . The market players are :

Government of any country

As stock markets are considered as the barometer of an economy ,every government of any country wants to push the market booming . This booming market further attracts foreign capital which any government needs to grow the country .No Government of the country likes the bear market as it brings criticism for them .

Regulator of stock market

The market regulators also like the bull market phase for more time because rising markets result in additional revenue and commissions for them. They also try that bear market scenario should be minimised .

Stock exchange/Brokers

These are the platforms to facilitate the stock transactions for investors . During bull periods, the incomes of these agencies increase and during bear markets the incomes decrease . Hence these players also have deep desire that market should go in up direction only.

In the same way ,other participants like banks ,companies ,AMCs ,MF houses and investors all want that market to always keep on following a bull run .

This tendency of greed of the market makes the players biased and irrational .

Mistakes due to Behavioural bias

Due to irrational behaviour of the investor, lot of mistakes happen in stock market.

Selling the stocks in panic

The fear of the investors causes panic selling in markets due to bear market scenarios. Due to this ,the investors sell their stocks in losses.

Booking profit in stocks without any plan

Many investors book the profits in stocks without any concrete system and plan .This results in unnecessary brokerage charges and cash money generated is not used properly .

Emotional decisions in greed and fear

Due to greed and fear, the investors take irrational decisions and lose the capital .

Not taking the position despite complete home work

This happens due to indecisiveness and less conviction in particular stocks despite the study .This results in opportunity loss and the price of stocks runs .

Not buying already run stock- missed opportunity

This type of opportunity is missed due to not doing proper valuation of the company and only seeing the price and PE ratio. This happens due to lack of proper valuation with growth aspect and intrinsic value calculation .

Trading Vs Investing

Investors usually mix the trading concept with investing concept. If any stock is purchased for short term trading purposes and it goes down the purchase price ,the person holding the stock and the person becomes a long term investor for this particular stock due to loss aversion .

Not having system for buying ,selling and holding

Investors do not have the systems of buying ,selling and holding and random actions result in losses of capital .

Over trading

In the greed of achieving more profits ,the investors keep on over trading which results in huge losses of money.

Book Psychology of the Stock Market by George Charles Selden also explains these concepts in detail.

This book is very compact, written back in the year 1912. In the present time also ,the book is worth reading .

The stock cycle due to the Psychology of stock market

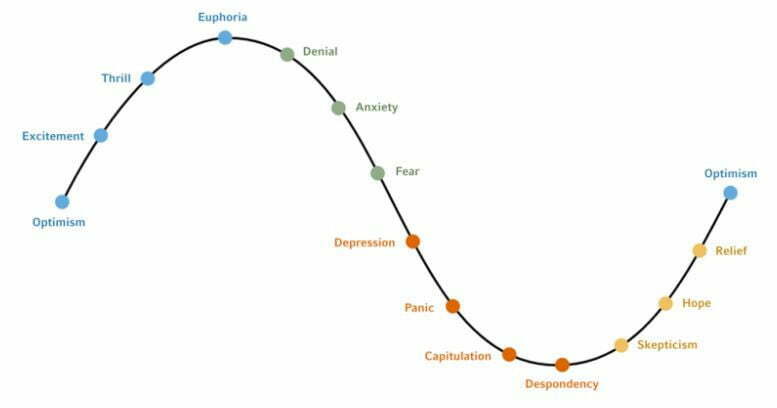

In terms of psychology of the investors and as per economic cycle, which has four parts like expanding , top or peak, decline stage and recovery stage. In the same way , stocks can also be explained in four different stages.

Accumulation

It is the stage in which the buyers start accumulating the stock in anticipation of any growth trigger in near future.

Mark-up

In this stage , once buyers take control of the stock, a bull run in the market starts as price keeps on touching higher

Distribution

In this phase , when the buying demand has exhausted and sellers take the driving seat. The sellers become aggressive and the price action becomes flat.

Decline

In this phase the price action stops and starts to the downside in search of demand to satisfy the aggressive supply being offered.

Conclusion : Ways to manage psychology when investing in stocks

It has been observed in the markets that 80 % new investors quit the stock market as they get the initial stock loss. So it is said that every person in the stock market loses money . This is called the tuition fee given to the market .

But the investors who somehow overcome the initial losses, they make a lot of money from the stock market.

Follow a long term investing plan-start with small

You as a retail investor should plan your financial goals and targets .These targets with exact timelines should be connected with your long term investing plans

Make a checklist-Gain consistency

You should make a checklist for consistency and stick to it for the disciplined system . You should have a firm checklist for better results .

Learn from mistakes and maintain an investing journal

You should keep on learning from your mistakes and also from others’ mistakes . This process of daily learning and becoming wiser every day results in compounding .

Slowly build confidence

The investing should be done in SIP mode and the investors should avoid big capital investments in one go. SIP route averages out the prices and minimises the chances of losses.

Risk management

Risk management is the most important virtue of any investor. Capital protection is the ultimate goal in the share market . Once the investor survives for a long time in the share market ,he becomes wealthy .