There are numerous approaches for investing in this world. You as an investor should follow the investing style which suits you as per your financial planning.

Coffee can investing approach has been explained in detail by Saurabh Mukherjea , a renowned investor in India.

Introduction

Sourabh Mukherjea has explained the financial planning through a story. In this book the author started with explaining in detail about frequent mis-selling of financial instruments in society by financial advisors.

Mostly Indian investors invest in physical investments like gold and real estate. The trend of investment in the stock market in India is only 2-3 decades old. If you are a keen and curious investor, you should keep on reading the summary of chapters.

The insight of books will definitely add precious wisdom in your Investing journey

Chapter 1. Mr Talwar’s Uncertain Future

The book starts with Mr Yogesh Talwar celebrating his son’s success in class 12th board exam. Mr Yogesh Talwar starts thinking about his financial future. He keeps on thinking about his achievements and financial performance.

He realizes his seven mistakes committed by Mr Talwar in his life .

- No clear investment objective/plan:

- Trading too much, too often

- Lack of diversification

- High commissions and fees

- Chasing short-term returns

- Timing the market

- Ignoring inflation and taxes

The leanings from this is that an investor like you should prepare his financial plan in detail and stick to it.

The investor should not depend only on real estate and gold .You should rather diversify your portfolio and include equity components to it.

Chapter 2. Coffee Can Investing

In this chapter, Saurabh Mukherjea explains the importance of equity investing .

The base of successful investing is the selection of stock and the decision of time duration to hold the stock.

The myth that higher returns from the stock markets are achieved by higher risk is to be broken .The wealth can be made without taking risk.

The author takes us back in history to explain the coffee can portfolio. Kirby, in an article written in 1984, explained that the good companies having high quality performance gave high returns in a long period.

Kirby gave the term ‘Coffee Can Portfolio’, when Americans, before the banking system, used to save their valuables in a coffee can and hid that under a mattress.

The businesses with high earnings and with low capital requirements are the best businesses to invest in long term.

The criteria for coffee can investing portfolio are:

The twin filters (ROCE above 15 per cent and revenue growth of 10 per cent) .

| ROCE | 15% |

| Revenue Growth | 10% |

After identifying the great companies with the above criteria , Saurabh Mukherjea recommends holding these companies for ten years. The magic of compounding works in these companies with deep MOAT.

These high quality businesses have great investment options to compound the business intrinsically.

In this method of investing, the short term volatility is to be ignored and you should sit tight on the company for 10 years.

In this way, coffee investing works on the principle of power of compounding. The companies selected in this way are more structural rather than cyclical in nature.

Chapter 3 Expenses Matter

“Beware of little expenses. A small leak will sink a great ship.”

Benjamin Franklin

Saurabh Mukherjea emphasizes that even a small expense in investing results in a big difference in the long term.

The three major expenses are given below which you and I pay knowingly or unknowingly.

Transaction fees

These are fees charged by brokerage firms during the transaction of buying or selling.

Annual fees

This fee is charged by the fund manager of the fund house as an annual fee for managing the money.

Hidden fees

In many insurance and MF products, these fees are hidden and not known to the investor .

Chapter 4. The Real Estate Trap

Real estate is the most favourite asset class in Indians along with Gold.

There are number of problems associated with investing in real estate like low returns in long term, highly illiquid and non-standard assets.

Real estate gives far less returns than equity investing but the investors who do not understand the investing well keep on investing in real estate and neglecting the power of equity investing.

Real estate is also not the sector which cleans accounting. The transaction charges and registration charges are also high in real estate

Chapter 5. Small Is Beautiful

In this chapter Saurabh Mukherjea has discussed that small cap companies have out performed large Cap companies in most of the stock markets in the world.

The reason for high return in small investing is due to lesser coverage by the media. Once more research done by brokerage analysts and interest is attracted from institutional investors, the re-rating of small cap stocks takes place.

On discovery of the share by all by big players, the stock keeps on growing and becomes mid and large cap within short period.

However, the small cap companies are riskier and you should invest in small cap companies as per risk taking capacity.

Chapter 6. How Patience and Quality Intertwine

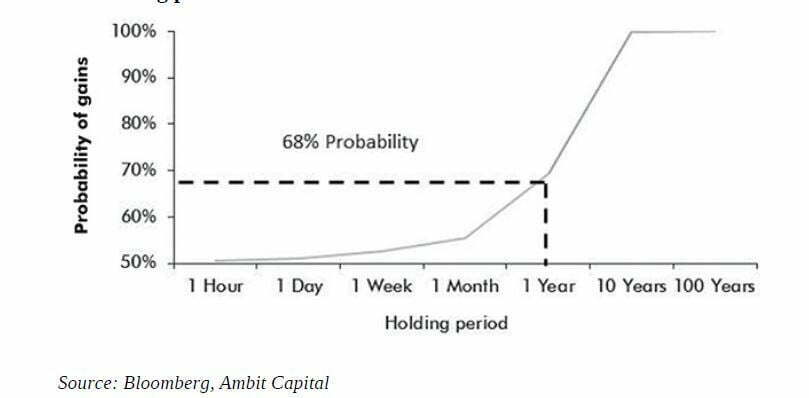

In this chapter, Saurabh Mukherjea mentions the importance of patience and long term holding period. He introduces the term patience premium which means that longer the holding time of a stock, better are the returns generated by the investors.

He also added another term ’Quality Premium. Quality Premium means the difference between the returns given by particular stock and benchmark index.

As per the observation, the portfolio with high quality stocks along with a long holding duration gives the highest returns and low risk.

In this way, combination of quality premium and patience premium together make Coffee Can portfolio with returns beating market index.

As shown that the probability of gains increases as the holding period increases.

Chapter 7. Pulling It All Together

While creating the Coffee can portfolio, you should consider your three categories of goals

1.Security

2.Stability

3.Ambitions

To achieve the successful Coffee can investing, investor should follow proper equity allocation in large cap ,small cap companies ,Index funds and ETFs

The criteria of Good and Clean companies should be used for constructing a coffee can portfolio.

Saurabh Mukherjea has explained the check list for clean accounting checks like Cumulative CFO/Cumulative EBIDTA, Doubtful debts, Pilferage checks and Audit quality checks etc. ‘

According to Saurabh Mukherjea ,the investor like you should make a financial plan as per life goals and stick to the same with discipline .

Chapter 8. Designing Your Own Financial Plan

In this chapter ,author has given the steps for own financial plan.

Step 1: Key in your cash flows

Step 2: Key in your portfolio and assets

Step 3: Key in your goals

These steps are to be taken by the investor to invest in diversified portfolio .

Conclusion

Coffee can investing :Saurabh Mukherjea is the excellent book for the learners of investing as it give the perspective of finding the good quality companies and holding for long term for making wealth.