It is human tendency to focus only on increasing income without considering the importance of personal financial planning. In fact understanding the personal financial planning and strategies to improve it continuously is the real mantra to achieve wealth

What is Personal Financial planning

Personal finance or financial planning is the tool to have better management & control over one’s finance. So if you want to become a planner for your financial journey, ask the following questions from yourself and find the answer.

And many more questions ….

Now we will try to find the answers of above questions together. If we could get reasonable answers of these questions for our future life than we have prepared to implement steps for financial success.

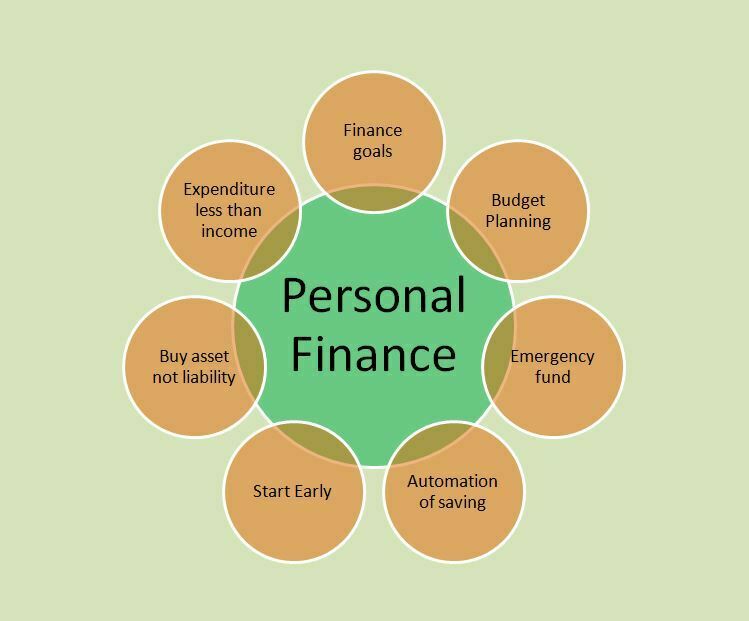

Strategies of personal finance

Prepare financial goals

“A goal without a plan is just a wish.”

Antoine de Saint-Exupéry

Goals preparing means breaking the success into steps so that the path becomes clearer and easier . The goals like purchase of vehicle, purchase of house, education of kids, marriage of kids ,holidays or retirement planning are to be well quantified on time lines to make the goals achievable .

As experts have summarized that goals should be SMART.

S : Specific

M : Measurable

A : Actionable

R : Realistic

T :Time -bound

You should classify these financial goals as short-term, mid term and long-term goals as per your planning. After making the goals, continuous re-evaluation of the financial goals is needed .The same can be modified considering new changes in life changes and new objectives.

Budget

Budget is the tool for control on expenditure ,debt and maximizing income . Budget will plan the monthly or annual expenditure .

If you find that you are spending more than the planned expenditure in any category; the same should be plugged and reviewed.

Budget is just like continuous surveillance on our expenditure, debt and income.

Automation of savings

Automatic deduction of savings before expenditure accumulates the wealth. The best method is investing through SIP route which automatically deduct the amount from account before available for expenditure.

If you want to invest in the future, you can follow investing in market indexed mutual funds.

Automation of investment enables investors to contribute money to an investment account at regular intervals in a pre planned strategy.

Automation of investing can be done in following instruments for Personal Financial planning .

- Share market

- Bank FDs or RDs

- PPF or EPF

- NPS

- Post office plans

- Gold

- Mutual funds

- Index Funds or ETFs

- Land

Early starter: to achieve fruit of compounding

Compounding effect works when we invest the little amount for a long period of time. Compound interest works slowly in starting but once the base becomes large, it compounds very rapidly .

“Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it“

Albert Einstein

Warren Buffet is the great example of early starter as he started his investing journey at the age of 11 years and accumulated a massive wealth in long span of more than 80 years.

Expenditure always less than income

If a person plans his expenditures always less than his income, he can definitely avoid debt trap.

Emergency fund

You should at least keep six months or more of your job income in savings account or ready to use account. This is required as you might lose your job any moment and you can sustain for minimum six months without affecting long term investments

Try to buy asset not liability

Don’t buy needless things. Stick to the basics: food, clothing, and shelter. Buying avoidable things and liabilities will eventually make your poor in long term. If you have extra money from saving, the same should be invested in assets like stocks, bonds, mutual funds, rental property or land. To understand the asset and liability, the Guru Robert Kiyosaki has mentioned the difference between them in detail.

What are Assets and Liabilities? Want to be rich?

Importance of financial planning

Financial education and planning is important not only because financial planning offers a base for financial decision-making, but also required to increase financial responsibility.

Must read books for financial literacy and personal financial planning

To make yourself aware, you may read the following books .

- Rich Dad Poor Dad

- Think And Grow Rich by Napolean Hill

- Rich dad’s Cash flow quadrant

- The Millionaire Next Door

- From The Rat Race to Financial Freedom

- The Simplest Path to Wealth

- Your Money Or Your Life

- The Intelligent Investor

- The Richest Man In Babylon

- Stop Acting Rich

- MONEY: Master the Game

Conclusion : Key takeaways

- Pay yourself that means automated saving before expenditure of money.

- Try to avoid debt trap.

- Don’t buy liabilities ,buy assets

- Buy things that will make money for you. i.e assets buying .

- This is not possible to achieve financial freedom without a financial saving plan.

- To save money, it is necessary that you have financial literacy.

- You should invest in you to learn financial education .