Investing Vs Speculation ,Difference between investing and speculation ,Investing ,Speculation

“Price is what you pay, value is what you get”

Warrren Buffett

“Easy rules for Investing Vs Speculation” this is the question every new retail investor is asking or trying to reply nowadays. Retail investors like you and me face problems and frequently get confused between investing Vs speculation .

Though the answer of this question is not easy and not clear , still I will try to throw some light on the topic so that you may understand the concept.

Investing and speculation are two extremes between which all the actions in the capital market exist.

What is investing ?

“An investment operation is one which, upon thorough analysis promises the safety of principal and an adequate return. Operation not meeting these requirements is speculative.”

Benjamin Graham, the father of value investing,

Before understanding the difference between investing and speculation, you should first understand the investing.

Investing is the process in which an investor targets to achieve financial goals. Investing is an umbrella term which includes investing in stocks, bonds, ETF, mutual funds and other assets like gold or real estate.

As per Benjamin graham definition the investing can be understood based on four basics.

Investment operation

Investment operation is the vast activity including research , understanding the investment , finding appropriate value and then continuous tracking and monitoring the investment in a systematic way .

Thorough analysis

Buying the share is considered buying the business and partnering in the business. Hence detailed and thorough analysis is done before investing in any company just like someone starts a new business.

Safety of principal

According to Benjamin Graham and Warren Buffet ,safety of principal is the most important criteria in investing . They suggest the concept of margin of safety which protects the principal capital of the investors.

An adequate return

After achieving all three above targets, the investor should focus on higher Returns. The investor gets the handsome returns once they understand the risk and reward after thoroughly studying the businesses and their thesis /antithesis.

What is speculation ?

Investing without understanding the underlying business to achieve short term higher returns on the basis of technical chart ,price action and momentum is speculation .

In speculation ,the investor misunderstands that he is also doing investing and does not take measures to protect capital and and takes higher risks.

In other words , if you as an retail investor are investing on the basis of some tips from any authorised experts , friends, or any colleagues for buying ,you are coming in the category of a speculator .

Speculating also become all the more dangerous for investor’s huge capital loss as there is no skill developed by the investor and the base of investing is not systematic .

Difference between Investing Vs Speculation

If we want to reply to the question “difference between investing and speculation” in a single sentence then it will be very tough.

Investor buys an asset thinking the price in terms of value and future cash flows while the speculator buys the stock with the aim to sell at a higher price in future.

There is a very small difference between investing and speculation which is not easily detectable.

Players in the capital market frequently get confused between both as they are ignorant about the concept.

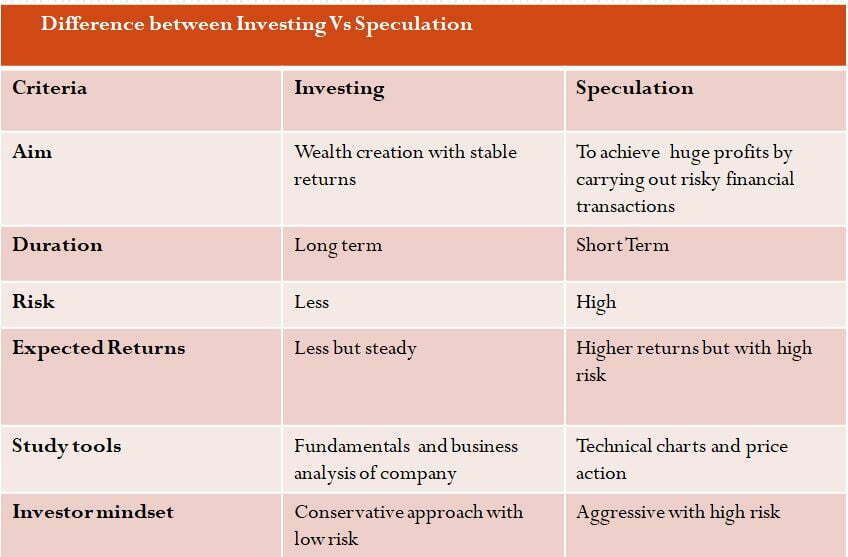

Difference between investing Vs speculation

Are you investor or speculator ?

Nowadays many new investors have entered the share market due to the attraction of share market for making easy money and quick returns.

These investors are trying their luck in the share market without learning the skills of investing which becomes the reason for big losses.

As per difference mentioned above, you may easily understand and categorise yourself between investor and speculator . You may modulate the your strategy as per your targets.

A very insightful book “The Clash of the Cultures: Investment vs. Speculation” by John C. Bogle covers the subject in details.

Conclusion

“The first rule of an investment is don’t lose money. And the second rule of an investment is don’t forget the first rule”

Warren Buffet

The investor should target for long term wealth creation rather targeting for short term risky gains as delayed gratification always results in steady returns.

In short term ,it may look that the speculator has gain the returns but as the speculator invests without system once a huge loss comes ,the whole capital gain is wiped out. In this way, this risk taking nature of the investor results in vicious cycle .Hence you should understand easy rules for investing Vs speculation to declutter the systems.

You as an investor should have your financial planning connected with financial goals and should follow with discipline to achieve the success .