Passive Investing: Index fund Vs ETF, Types of Investing, Active Investing ,Passive Investing ,Index Investing ,ETFs

Investing is such a vast subject which takes long years to learn the ins and outs of the subject. Investing has many faces in the process which you as an investor need to understand before starting your investing journey. Like active investing ,passive investing ,ETFs or Index Investing .

Types of Investing

According to the investing process, the investing can be divided into a number of types. According to involvement of investor in investing, it can be divided into two types

1. Active Investing

2. Passive Investing

As active investing has potential to generate more returns than passive investing, let us understand together, what type of investing is to be followed by you.

1. Active Investing

Active investing means to buy and sell financial instruments like stocks or bonds based on current market scenario and as per asset allocation of respective schemes. The aim of active investing is to outperform the market or beat benchmark.

2. Passive Investing

Passive investing means simply following the index or benchmark passively. In fact passive investing involves copying or mirroring benchmark or index to generate similar returns.

For example: just copying the Nifty index or SENSEX Index is called a passively managed index fund.

This type of investing involves investment in the same stock that constitutes a market index in the exact same proportion to duplicate the index performance.

You as a small retail investor get confused as to which investment you should follow among an ETF, index fund or mutual fund.

Slowly the passive investing like ETF and index Investing have grown in attractiveness versus active investing due to less research required and lesser expenses.

Types of Passive Investing

Now you have understood passive investing. Let us deep dive in routes of passive investing which are mainly two:

1. Index Investing

2. ETF

Index Investing

Index investing was first started by Vanguard fund founder Jack Bogle in 1975. The basic strategy behind index investing is that a Portfolio is made having same composition of a index. Index investing is a type of mutual fund investing .

The composition of shares is same which match the performance of the index. For example: NIFTY Index, S&P 500 Index and SENSEX Index.

To make further clear to you people, I will give an example.

Nifty 50 in India constitutes of 50 stocks so if a fund manager want to track the Nifty index he will invest in 50 companies as per the original weighted composition of NIFTY. In this way the performance of this Index fund will be same as Nifty 50 performs.

The accuracy of this copying is measured in terms of tracking error.

Lesser the tracking error more accurate the Index funds. In index fund investing the investor does not chase the Alpha returns above Index rather fund manager follows the index and want to get the same returns as index performs.

You may search various Index Funds from different sources and different Fund Houses/ AMCs .

ETFs

ETFs are exchange traded funds. ETF is a basket of stocks which follow any Index.

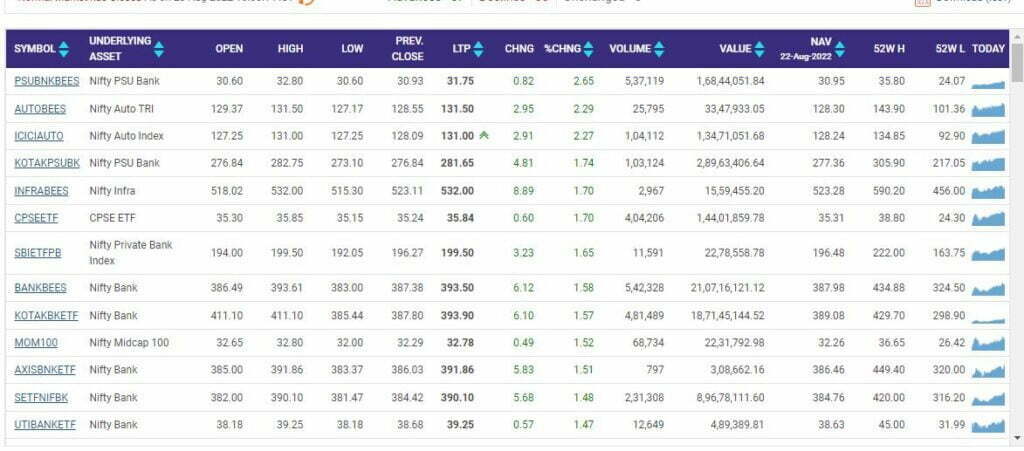

ETFs are flexible investment and highly liquid as they can be bought and sold on stock exchange during the trading day.

As ETFs are traded on stock exchange these can be bought and sold through Demat account.

You may invest in ETFs as per your planning . Lot of ETFs are available in India to invest

Comparison /difference between Index Investing Vs ETFs

Conclusion

As you have understood from above explanation that ETFs and Index Funds are pretty similar. Hence selecting one from ETF and Index fund ,as a retail investor like you should think in terms of your future goals and your investing behaviour .

The decision of investing is to be taken as per your financial plans .

For example, if you have planned for long term goals and you want discipline in your investing journey, you should follow SIP route and keep on investing in Index Funds .

However on the other hand , if you are keen observer and find interest in tracking the market , you may follow investing in ETFs .You may invest more aggressively in ETFs during bear market to maximize your returns .

Also selecting between an Index Fund and an ETF is dependent on investor’s behaviour . ETFs offer lesser expense ratios and greater flexibility, while Index Funds make the investor to take simpler trading decisions and get the more returns .